PT BNI Life Insurance (BNI Life) launched a new insurance product in collaboration with PT Bank Pembangunan Daerah Jawa Barat and Banten, Tbk (bank bjb) through the Bancassurance channel. The launch of the collaboration between BNI Life & bank bjb was held virtually on Thursday (05/08). The event was attended by Neny Asriany, BNI Life Business Director and Suartini, Consumer and Retail Director of bank bjb.

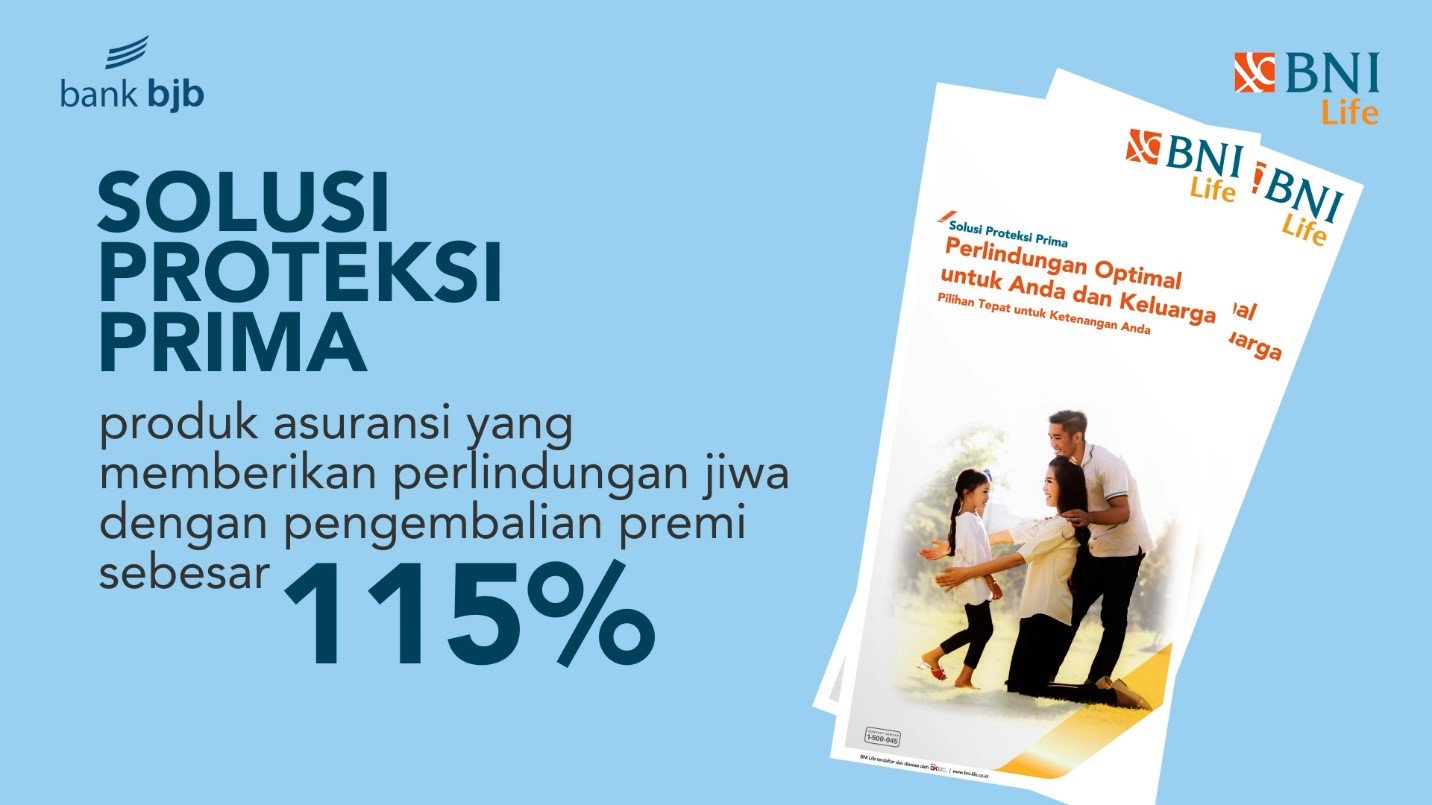

We offer BNI Life's flagship insurance product called Solusi Proteksi Prima for priority customers of bank bjb. This product is a traditional endowment product with a one-time premium payment method and provides a premium return at the end of the contract year of 115%, explained Neny.

We have placed competent marketers to work with fellow marketers of bank bjb to provide the best service. In the future, we hope that BNI Life can become a good partner for bank bjb so that this collaboration can run continuously and continue to grow in the future, concluded Neny.

Suartini explained that the wealth management business in Indonesia continues to grow every year, so we are required to continue to innovate in providing alternative financial products such as protection & investment. Currently, bank bjb has developed into a bank with a large number of customer portfolios and has the potential to continue to grow.

On this occasion we decided to add a new partnership with BNI Life. The purpose of this collaboration is to create one stop financial services in order to increase customer loyalty of bank bjb as well as to increase fee based income. We believe BNI Life can provide the best service for all bank bjb customers, said Suartini.

The Indonesian life insurance industry showed positive growth in the first quarter of 2021. Citing the release of the summary of AAJI's performance, Bancassurance premium income grew by 28.5% YoY compared to the same quarter the previous year. The total reached Rp 57.45 trillion, while the total premium income from new businesses was Rp 37.04 trillion, which is the largest source of income or equivalent to 59% of the total revenue of companies under AAJI.